You Trade Forex

YouTradeFX is one of the fastest growing Forex companies as of this year. They are constantly optimizing and updating its trading platforms and inventing ways to make the trading world a more user-friendly one. Additionally, YouTradeFX has extended its website and trading platform so traders today can more easily invest in CFD’s on stock, commodities, indices and the foreign exchange market.

YouTradeFX History and Background

YouTradeFX got its start in 2009 and has already achieved initial revenues over $1.5 million from over 2000 global customers. YouTradeFX addresses a growing client base of private and professional traders, 24 hours a day, six days a week, providing specialized trading services in over ten languages.

With optimal trading conditions, updated offerings, innovative technology and high quality support, YouTradeFX addresses the introducing brokers’ business needs while allowing for considerable extra income with their flexible revenue plan and withdrawal policy.

Advantages of Trading with YouTradeFX

YouTradeFX has developed automated trading tools (expert advisors, custom indicators and scripts) that require minimal intervention and allow traders to automate their trading strategy, improve discipline, remove emotions, and capture opportunities. Traders can choose from over 20 predefined trading strategies to create custom portfolios and automatically execute trades according to their specifications.

Their website features premium video tutorials to help traders get started or optimize their trading strategies. The tutorials range from basic techniques, technical analysis, fundamental analysis, to the types of risk and money management needed to become a successful trader. Traders account and apply the lessons they chose to the real-time market.

Trading Platform

YouTradeFX uses Meta Trader 4 and now, Meta Trader 5

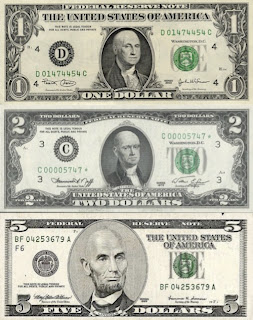

Deposits and Withdrawals

Deposits are made with major credit cards, debit cards, paper checks, money bookers and wire transfers. All requested withdrawals are processed the same working day and transferred to the trader’s account within three business days.

Customer Care

YouTradeFX values their customer service. 24/6 support in ten languages is available at your request via email, phone, and live chat.

Security

YouTradeFX is regulated by the Federal Security Commission.

Conclusion

YouTradeFX provides all levels of traders with the best tools to invest in a controlled and measured manner. “Your gain. Our goal” reflects their commitment to offer both customers and business partners a wide array of trading instruments and one on one support for their traders to make sound decisions and lead them to a real profit.